21 Ways To Make Budgeting Fun

It's one thing to sit down and make a budget once, which we know isn't the most fun thing to do. It's another thing to sit down every week or month and keep that budget up to date. As with exercise, you may feel great when you're done, but it can be a drag to do. That's where the 21 Ways To Make Budgeting Fun comes in.

With all of this in mind, one way to get out of that system is to make a budget. Even though financial advisors like me use the word "budget" like it's a human GIF, the word doesn't exactly scream "good times," does it? However, it turns out that some hidden tricks can make budgeting fun.

Let's be honest: nobody likes the word "budgeting" unless, of course, you're a young accountant or financial planner. There's nothing more boring than making a budget for everyone else. But the thing is, it's one of those stressful jobs that you have to do if you want to keep track of your money and make sure you have enough money for your next night out.

Understanding budgeting

Budgeting in the traditional sense is not enjoyable. Most people must create a horror spreadsheet of all their fixed costs before estimating how much they "should" spend on food, shopping, travel, Uber/Lyft, etc. You tell yourself you'll only spend $200 on food for a month and keep track of everything you buy (or maybe you get fancy and plug everything into Mint).

However, you've spent $257 more than you should have by the end of the month, making you feel like a failure. So you realize you're not very good at budgeting and give up.

Perhaps you employ a simple budgeting system such as the 50/30/20 rule, which states that 50% of your expenditure should go to needs, 30% to wants, and 20% to savings.

Doesn't it sound reasonably good? But everyone who lives in a metropolis, particularly in New York and San Francisco, is laughing so hard that they can't cry right now because they just signed a new lease for their apartment that costs one entire paycheck. You fail before you even begin.

There Are No Rules To Budgeting

There are no rules of thumb or magic formulas for budgeting. This may sound scary or frustrating initially since we all want to know if we're doing it "right." But here's what makes it exciting: if there aren't any rules, there's no way to fail. It's impossible to be wrong.

Related: 11 Great Ways to Save Money Without a Bank Account

Budgets are personal. Your budget should reflect your values, not those of anyone else. The idea that where you spend your money shows what you value is one of the best pieces of advice I've ever heard. It can be hard to stop if you don't know why you're buying the things.

Budgeting is also a way to see if you're going in the right direction or if you need to make a change—one of the first things you can do to help your budget isn't spreadsheets or transactions.

The Urgent/Important Spending Matrix lets you think about your spending based on what matters to you, not on a bunch of "shoulds."

21 Ways To Make Budgeting Fun

Here below are 21 apps for budgeting.

1. Just Make It Easy And Simple

The easier and simpler something is, the more fun it will be, and it won't take long to do. The same applies when creating a budget, whether weekly or monthly. You also avoid stress for sure.

To make it fun, you can start by creating a particular schedule for budgeting. Of course, the time must be the same, for example, every 1st or on payday.

Then, to make it easy, there is no need for super detailed budgeting, with more than 100 categories of needs, for example. Later you can feel overwhelmed when you have to stick to the budget. You can start with 15 - 20 varieties of needs. Choose a number that suits you; no need to follow other people's needs and budget categories.

2. Get Crafty With Debt Charts

Getting crafty with debt chats is one of the fun ways to budget. You'll get a balance update on the next billing cycle when you're paying off debt. But it's still hard to understand how much you pay each month and how far you've come in paying off your debt. These debts can be enervating.

Turning your debt into an interactive chart is a fun and easy fix. Create a debt chart using arts and crafts supplies or your favorite editing software.

Make a chart for each bill you're paying down, or make one big chart to show all your bills. Fill in your progress with each payment to see how far you still have to go until your debt is paid off.

3. Use A Visual Progress Tracker And Break Out the Monopoly Set

Having fake money in front of you will make your real money seem more natural since we don't deal with hard cash as much as we used to.

One of the best ways to make budgeting fun is to have a picture of how your money is going.

When you can see your progress right before you, it's much easier (and more satisfying) to keep going with your budget.

Getting out a game of Monopoly is a fun and hands-on way to budget. Use the visual tracker to represent your current income and the properties to describe your bills and other financial goals you want to include in your budget. This makes it easier to see where your money is going and where you are falling short.

You can do this in a lot of different ways. For example, you can make a "color-in" progress tracker that you color in every time you put money into your savings account. Or, you could make a spreadsheet with a line graph or pie chart that shows your progress.

No matter what method you choose, you must ensure it's something you'll use and see daily.

Related: 65 Clever Money Hacks That Will Save You Hundreds of dollars

4. Focus on Your Financial Goals, Not Just Dollar Amounts

Take the time to make a list of financial goals you want to achieve, both short and long-term. For example, do you want to travel to Europe one day? Do you want to pursue higher education? What about retirement savings and emergency savings?

After that, you can set a budget for each goal. When there is something you want to achieve, you will look at budgeting differently. You become excited and enthusiastic when preparing a budget. After all, budgeting is simply about deciding how you will use your money.

Having fun while budgeting is about controlling your money. For example, maybe you want to free up cash to take a vacation or buy a new pair of shoes. You can more easily achieve whatever you want when you connect your budget to your goals.

That in itself makes budgeting more fun. No one likes to do something just because they should. Budgeting will come much easier when it becomes something you want to do because there's something valuable in it.

So, think about the reasons why you want to budget. Are you trying to free up funds for something specific? Do you want a little extra financial security? Are you saving for long-term goals or trying to get out of debt?

You might even get a picture of your end goal, such as the place you'd like to travel to and post it somewhere where it will always be top of mind. Then, you'll see that end goal every day and can watch your finances more closely to reach that goal.

5. Consider The 52-Week Challenge

"The 52-week challenge motivates you to make periodic deposits to your savings account for a particular time.

Here is how 52-Week Challenge works for Fun Budgeting:

- Put $1 in your savings account in Week 1 of the challenge.

- Put $2 into your savings account in Week 2.

- Continue to add a dollar each week until you reach the 52nd week, when you will add $52.

You'll save $1,378 at the end of the 52-week challenge. Not a bad method to put money toward a holiday or emergency fund."

6. Give Yourself A Reward

Sticking to the budget takes consistency and discipline; if you can do it, that's a big deal. So, there's nothing wrong with giving yourself a reward when this happens since giving yourself rewards for reaching budget milestones makes budgeting more fun.

It doesn't have to be a lot of money. For example, you could treat yourself to a spa or a fancy restaurant before making your next budget.

For example, you could add $50 to your fun money every time you stick to your monthly budget. Or, you could take a weekend trip for every $5,000 you saved or invested.

Not everything has to be complicated. The key is to develop a reward system that works for you and keeps you going.

But what if you can't stay within your budget? You don't have to be mean to yourself because that could make you stop budgeting. Most importantly, you figure out what went wrong and try to fix it so you can get closer to your financial goals.

Read also, How to Save $10,000 in a Year

7. Make Budgeting Fun by Getting Competitive

If you really want to make budgeting fun, try competing against a friend. Also, if you're tired of living paycheck to paycheck, one idea is to talk to your friends and find out who else needs a budget, like, yesterday.

Get together with those friends and see who can spend the least money next month. The winner gets to brag, and the losers have to buy a small trophy for the winner. Of course, the best award would be something you can eat, like a milkshake.

You can make weekly or monthly budget challenges and compete with a budget buddy, your spouse, or even a group of friends.

"For instance, compete to see who can save the most money in 30 days," said Woodard. "Or try a "14-day no eating out" challenge to see who can keep it up.

You can make budgeting fun by coming up with different kinds of competitions. The thrill of beating a friend is a great way to keep yourself on track with your money goals and hold yourself accountable. Plus, if you win, you get to brag about it, and who doesn't like that?

8. Save Up for Something the Family Wants

You can make budgeting fun for your kids or other family members who don't want to do it by saving money for something exciting.

It could be a family vacation, like an RV trip to the national parks or a trip to Disney, or a family purchase, like a pool or something else the whole family needs and wants.

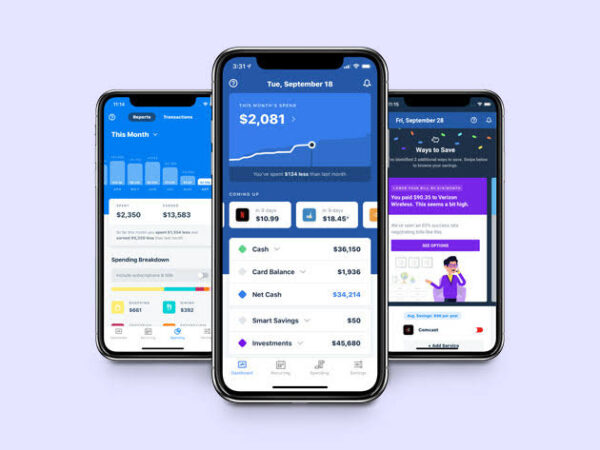

9. Use an Application That Can Help you Budget More Easily and Practically

Creating a budget by hand takes more time than using an app. You must figure out the budget, keep track of everything, etc. At some point, you'll realize it's not very fun.

How to make making a budget more fun? First, you can use a personal finance software. With a budget planner, it's easy to divide your needs into different groups. A good budget planner lets you set up as many budgeting categories for saving money and spending money as you want.

Then, you can move the budget from the Main savings category to any Saving and Spending categories you've created. After that, when you start to use the budget, you can keep an eye on it in real-time.

Get a budgeting planner and app with a spending analysis feature. You can also compare expenses between months in terms of percentages. Having an easy-to-understand planner makes budgeting more fun. This way, you can keep an eye on your money anytime. Isn't it great?

Related: How to Make a Personal Budget in 6 Easy Steps

10. Give Your Money Funny Nicknames.

This one discovery will change everything you know about money. Finally, you can give your bank accounts nicknames like pets.

Not only does giving your accounts names like "Window shopping Savings," "Adulting Dollaz Only," and "Jenny's Banana Stand" help you keep track of your money. However, such names also make you feel more connected to it because you named each account after a part of your life. It's fun to open my bank account because of this and have them pop up, and it makes me smile.

You can use a Sharpie to write what it is for on the back of your debit and credit cards. When I look at my bills-only card and see, "Hey. Bills Only," I don't spend my rent money on Prime Day. On the other hand, pulling out my "I'm going shopping" card is a great way to start a conversation with a stranger at a bar.

And an extra? I love it when my bank's customer service tells me things like, "Mr. Jake, are we putting this check in your, uh, Ratchetry Account?" Then, all of a sudden, banking is funny.

11. Create a Bae Day for Your Budgeting

Put Bae Day on your Google Calendar because it's about to become your new favorite event. You'll open your bank accounts and move your money around during this hour to have enough for the next two weeks.

Why Bae? Before anything else is what "Bae" stands for. Ideally, this appointment will be on the same day you get paid, so you can start this ritual Before Anything Else happens to your money. You can call it BFF day.

Making your money your "Best of Friends" will make it more acceptable to you and more fun to work with.

Plan a Bae Day for yourself once every two weeks for at least an hour. Protect this time like a doctor's appointment, and ensure it's early in the week, so you're not too busy with work and tempted to skip out.

Here is the natural way to keep your Bae Day:

Think about the most fun and self-care-y things you never have time for. Do you wish you had time for a charcoal mask once a week or a Hamilton dance party without pants? Now is the time.

Make sure you do that thing before, during, or after you work on your budget. It's all about tricking your brain. Even if you don't like budgeting at first, you'll start to look forward to this time as a form of self-care (and money care is self-care!).

Don't miss this: Survey: Half of Americans Don't Have $250 to Spare (And Why You Should Learn to Save)

12. Date a Money Mate And Make it Sexy

One of the essential parts of making a new habit stick is ensuring you have someone to keep you from giving in to temptations. So, to make budgeting more fun, you need to find a Money Mate.

Your Money Mate is the person who will keep you on track with your money, and you can decide how the relationship works. For example, you can agree to give each other a 5-minute call before each Bae Day to make sure you're going to do it. You can also decide to be each other's emergency-text contact when you're tempted to buy everything in your Amazon cart.

Your Budget Money Mate needs to meet two essential requirements:

They shouldn't be too close to you and should have similar financial goals to you. For example, you might be working full-time but cutting costs to pay off student loans.

Paypant.com recommends that if your money mate is your partner, you should try to meet once a week to talk about their budget.

Make budgeting fun by getting your favorite drink and snack, turning off all distractions if you can, and keeping the mood upbeat. Don't pick apart each other's purchases; instead, focus on what you both like. Finally, celebrate each other, so you both feel good about money and budgeting. It will help you both stay on track.

If you make a mistake, your best friend or a family member might be too forgiving, so look for friends who aren't too close. You want to be close enough to someone that you can be friends with them but far enough away to feel a little pressure to keep it together.

Why It's Fun to Make a Budget with Your Partner.

Fighting with your partner is the least minor fun thing you can do. But, unfortunately, that's how many meetings about the budget begin and end.

Talk to your partner about the goal you want to reach. Why are you making a plan? Why does it matter? Want to save money for a trip? Do you want to stop owing money? You want to buy a home, right? If you both know and agree on the big picture, you'll start to get excited at your budgeting meetings when you see how close you are reaching your goal.

See

https://paypant.com/21-ways-to-make-budgeting-fun/

Comments

Post a Comment